Posts by admin

Did You Know You Can Borrow Up to $30,000 at Prudent? [New YouTube Video]

At Prudent Financial, we make it easy for you to get money when you need it. Did you know that you can borrow up to $30,000 through us? If you own your home or a paid-off car, you might be eligible for one of our home equity loans or other types of financing. See our…

Read More5-Star Reviews You Can Trust: Why Prudent is Stellar Choice for Personal Loans in Toronto

At Prudent Financial, we strive to offer excellent service to every person who calls our office or walks in our door. Whether we’re offering a personal loan, bad credit loan, mortgage financing, or more, we take our mission seriously. We’re thrilled to see that our customers feel the same way. Looking for a personal loan…

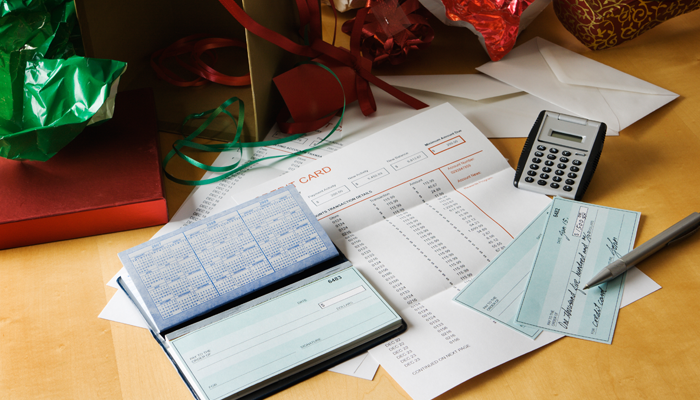

Read MoreHoliday Credit Card Debt Is In – Now What? Use Your Home or Car to Consolidate Debt

The holiday season may be over, but there’s one part of it that isn’t finished yet: holiday bills. Many holiday shoppers tend to put purchases on their credit cards, which means that after the holidays are done, they have to deal with the corresponding credit card debt. The 2018 holiday season was no exception, although…

Read MoreFun and Budget Friendly Winter Activities in the GTA

We’re in the middle of winter – the time when it can feel like the snow and ice will never end. If you’ve been spending the cold weather cooped up inside, take a break and venture into the great outdoors. You’ll want to get out when you hear about the great winter activities happening around…

Read MoreCheck Out the Prudent Financial CP24 Commercials: Personal Loans in Toronto and the GTA!

If you live in the GTA, you might have seen Prudent Financial on a TV near you! CP24 has been airing three commercials for our Toronto lending services. We can help with personal loans and more in the GTA and beyond. Borrow up to $30,000 when you come to Prudent Financial. Get a consolidation loan,…

Read MoreCommon Cold Weather Car Problems: Frozen Car Battery and More… Explore Your Options

Car won’t start, dead battery, frozen fuel lines, broken wipers, and more… Cold weather car problems can cost you a lot, both in time and money. With the temperatures we’ve been having this winter, car problems have abounded. And it’s not over yet. The Old Farmers’ Almanac is predicting more cold weather on the way…

Read MoreYou Can Start Rebuilding Credit the Day After Filing for Bankruptcy – Here’s How!

Filing for bankruptcy can give you a clean financial slate by erasing debt, but it also leaves you with the worry of never having decent credit again. Fortunately, this doesn’t have to be the case. While an R9 score remains on your credit report for seven years after bankruptcy, you can start rebuilding credit the…

Read MoreBudget Friendly Toronto Winter Activities for the Whole Family

Winter in Canada can sometimes seem like it’s too cold for much fun. But these Toronto winter activities will warm you and your family right up! These affordable family activities are easy on the budget and heavy on the fun. Check out our list of the top-10 recommendations for Toronto winter activities both adults and…

Read MoreBruised Credit? A Bad Credit Loan May Be the Only Answer – Here is What You Need to Know

If you have bruised credit and are looking for financing, you may be considering a bad credit loan. But if this is the case, you need to pay special attention to the types of loans available. Some aren’t as good as they appear to be. A bad loan can: Leave you in debt. Force you…

Read MoreBank of Canada Interest Rate Staying at 1.75% for January 2019

If your New Year’s resolution is to get out of debt, good news: the Bank of Canada interest rate is staying the same for the time being. On January 9, 2019, the Bank of Canada (BOC) announced they would not be changing the rate from its current 1.75% standing this month due to the global…

Read More