At one point or another, we all say it, “I’m going to get my finances back on track.” However, kind of like those infamous New Year’s resolutions that fall to the wayside by the end of January, when you don’t have a plan, it is easy for the good intentions to be cast aside. However, if your finances are causing you stress, getting back on firm financial footing is crucial, and a budget is the best place to start.

Here are some tips on how to create a budget easily – one that wins!

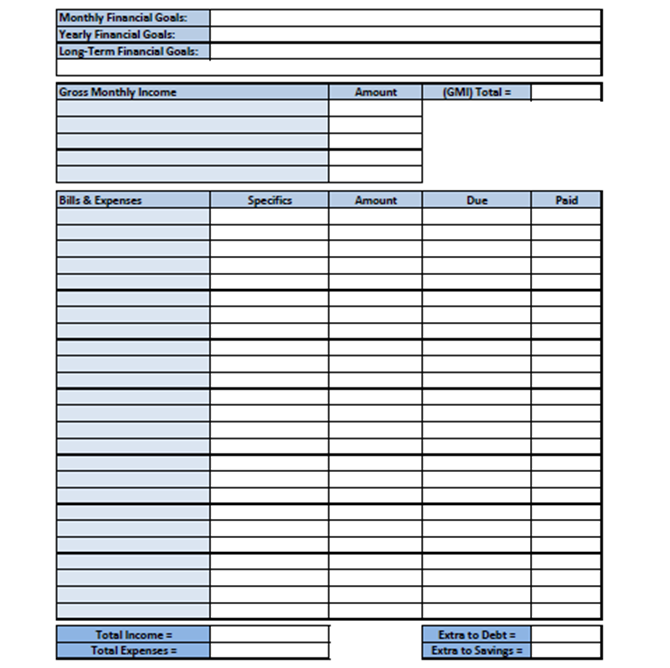

- Know why you are budgeting. Set a yearly goal. That may be saving money for a trip or paying off debt. Write this at the top of your budget as a motivation tool. Also be sure to set short term goals to help keep you motivated month by month.

- Know how much you make, how much you owe, and how much you spend – you want your budget to be as accurate as possible.

- Handy with Excel? Create your own budget, just make sure include all income and all expenses, and if you don’t know exact numbers, over estimate.

Not so tech savvy, or don’t have the time? Use this handy monthly budget template and fill it in according to your own personal finances.

- Be realistic. If you are trying to spend less, don’t go overboard with your goals. You likely can’t feed a family of four on $25 a month, so budgeting for that isn’t realistic. On the other hand, perhaps eating out 5 nights a week isn’t entirely necessary, and so cutting that down can make a big difference.

- Track, Monitor, and Be Disciplined. Keeping track each week does take some time, but it is worth if you are sticking to the budget. And adjust accordingly – if something in the budget isn’t working, don’t be afraid to tweak it.

When you are working towards a financial goal, a budget is essential. Use these quick and easy tips on how to create a budget and the results may just surprise you!

Want more tips on how to create a budget that you can stick to? Call Prudent Financial today 1-888-852-7647.